Are SCO Plots a Good Investment in 2025-26?

Introduction: The Growing Appeal of SCO Plots

The Rise of SCO Plots in Gurgaon

In recent years, Shop-Cum-Office (SCO) plots have rapidly emerged as one of the most lucrative and flexible investment options in India’s commercial real estate market. SCO plots, commonly found in places like Gurgaon, represent a unique blend of retail and office spaces—typically with retail stores on the ground floor and office spaces on the upper floors. This dual-functionality makes them highly attractive to both business owners and investors, offering steady rental yields and capital appreciation potential.

In comparison to traditional commercial properties such as malls and office towers, SCO plots stand out due to their freehold ownership, customization potential, and typically higher rental yields. While malls have witnessed fluctuations in footfall and declining popularity in recent years, SCO plots—especially in dynamic locations like Gurgaon—have shown strong resilience and growth.

Gurgaon’s commercial real estate sector has been a key driver of this growth. With its growing infrastructure, proximity to Delhi, and the continued influx of multinational companies, commercial land in Gurgaon remains highly sought after. This, coupled with Haryana’s pro-business policies, has led to a rise in the demand for SCO plots in Gurgaon.

What Are SCO Plots and Why Are They Gaining Popularity?

Defining SCO Plots

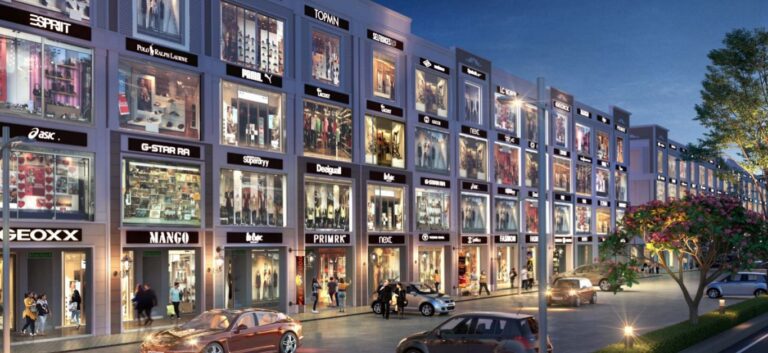

SCO plots are unique commercial properties that combine retail and office spaces within the same plot. The ground floor is typically designed for retail businesses, while the upper floors are reserved for office spaces, clinics, or other commercial uses. This dual-use design allows owners to diversify their revenue streams by leasing out both floors separately, maximizing income potential.

Unlike many other commercial properties that follow a leasehold ownership model, SCO plots in Gurgaon offer freehold ownership, meaning investors own the land outright, providing better long-term security and potential for appreciation. This freehold status adds significant value, especially when compared to properties that are bound by lease agreements, which can limit flexibility and control.

Key Features and Flexibility

SCO plots offer significant customization potential. Investors have the flexibility to design and build the property according to their specific business needs, which can significantly enhance the property’s value. This customizability extends to the design of the building, which can typically include a G+4 structure (ground + 4 floors) with a basement for parking or storage. This makes it possible to create a property that aligns with the needs of modern businesses, providing retail on the ground floor and offices on the upper floors.

Moreover, SCO plots come with reduced common area maintenance (CAM) fees when compared to conventional commercial buildings like malls or office towers. Since SCO plots are self-contained units, investors don’t have to share extensive spaces, thereby reducing overall maintenance costs and improving net returns.

Unique Investment Value Proposition

Investing in SCO plots offers long-term value creation. The flexibility of the design allows owners to adapt the space to changing market needs. For example, they can lease out the ground floor to a retail brand while using the upper floors for offices or clinics. This dual-income model increases the investment’s resilience, reducing risk by diversifying the tenant mix. Additionally, the capital appreciation potential in emerging corridors like Dwarka Expressway and New Gurgaon makes SCO plots even more attractive.

The Investment Landscape in 2025-26

Looking ahead to 2025-26, the real estate market in Gurgaon is expected to remain robust, bolstered by the rapid development of infrastructure, such as the Dwarka Expressway, metro connectivity, and new highways that improve access to this already thriving commercial hub. As these infrastructural projects mature, the value of commercial property in Gurgaon is projected to rise, making it an ideal time for investors to capitalize on SCO plots.

Additionally, economic conditions, including rising disposable incomes, expanding business activities, and an increase in urbanization, are set to drive demand for commercial spaces, particularly in key zones like Dwarka Expressway and New Gurgaon. This provides investors with an opportunity to generate high returns, both from rental income and capital appreciation, making SCO plots an attractive option for 2025-26.

Factors Driving SCO Plot Demand in Gurgaon (2025-26)

Strong Infrastructure Growth

Dwarka Expressway, one of the most significant infrastructural developments in the Delhi NCR region, has dramatically improved connectivity between Gurgaon and Delhi, as well as the IGI Airport. This development has resulted in rising demand for commercial land for sale in Gurgaon, particularly along the expressway. The ease of access and proximity to key areas have made it one of the hottest locations for SCO plots.

Moreover, other ongoing infrastructure projects, such as the RRTS (Regional Rapid Transit System) and metro expansions, are expected to further boost demand for commercial property in New Gurgaon. These projects will improve connectivity within the region, benefiting commercial plots in Gurgaon by increasing accessibility and footfall.

Proximity to Affluent Residential Areas

Gurgaon’s thriving residential sector has also played a key role in the demand for SCO plots. Areas like Sector 82A, Sector 114, and Golf Course Extension are home to a high-income population, providing a steady customer base for businesses located in these areas. The proximity of SCO plots to these residential hubs ensures high footfall and a ready market for retail and office tenants.

This strong demand from both residential areas and businesses alike makes SCO plots in Gurgaon an ideal investment, particularly for those looking to capitalize on the growing demand for commercial space in Gurgaon.

Haryana’s Favorable Real Estate Policies

Haryana’s Department of Town and Country Planning (DTCP) has introduced favorable norms for SCO plots, such as higher FAR (Floor Area Ratio), which allows developers to construct taller buildings and utilize more space. This flexibility in design and construction makes SCO plots more adaptable to market demands, thus increasing their value.

Furthermore, RERA approval provides investors with the confidence that the projects are transparent and legally compliant. This regulatory assurance adds a layer of security for investors, making SCO plots in Gurgaon even more attractive.

SCO Plots vs. Other Commercial Properties: A Competitive Analysis

Traditional Malls and Commercial Buildings vs. SCO Plots

When compared to traditional commercial properties like malls and office towers, SCO plots offer several advantages. One of the main benefits is ownership structure. While malls and office buildings often operate on a leasehold basis, SCO plots are freehold properties, offering greater flexibility and long-term security.

Moreover, the rental yield for SCO plots typically ranges between 6-8%, which is higher than the 4-6% yield from traditional commercial properties in Gurgaon. This makes SCO plots a more attractive investment option for those seeking consistent income.

Risk Diversification and Flexibility

SCO plots allow for diversified income streams, as the ground floor can be leased to retail tenants, while the upper floors can be leased out to office tenants or other businesses. This flexibility reduces the risk of vacancies, as the investor can attract a wider range of tenants. Additionally, the dual-income potential makes SCO plots more resilient in times of economic downturn, as they cater to both retail and office sectors.

How the Gurgaon SCO Market is Evolving (2025-26)

Key SCO Hotspots in Gurgaon

The demand for SCO plots is surging in locations such as Sector 82A, Sector 114, and Golf Course Extension, which are emerging as prime commercial hubs. These areas benefit from strong infrastructure and proximity to both residential sectors and key transportation routes like the Dwarka Expressway.

Ready-to-Move SCO Properties in Gurgaon

The demand for ready-to-move commercial properties is growing, as investors look for immediate returns. SCO plots in areas like Vatika Crossover and M3M 114 Market offer the opportunity to begin generating rental income immediately after purchase, making them highly attractive for investors seeking stable cash flow.

ROI and Capital Appreciation Projections for SCO Plots (2025-26)

Capital Appreciation Projections

Based on historical trends, SCO plots in Gurgaon have shown strong capital appreciation over the past few years, particularly in emerging sectors like Dwarka Expressway and New Gurgaon. Over the next 5 years (2025-2030), these areas are expected to see further price increases due to continued infrastructure development and growing demand for commercial space.

Rental Yield Potential

Given the dual-use functionality of SCO plots, rental yields are typically higher (6-8%) compared to traditional commercial properties (4-6%). The rental yield for SCO plots in premium locations like Sector 82A and Golf Course Extension is expected to remain strong due to high demand for retail and office spaces.

Key Considerations for Investors in SCO Plots

Location and Connectivity

The value of SCO plots heavily depends on their location. Areas with strong connectivity, such as Dwarka Expressway, NH-48, and Golf Course Extension, are highly sought after for commercial properties. These locations provide easy access to residential hubs, key highways, and metro stations, ensuring high footfall and long-term value appreciation.

Developer Reputation and Project Deliverability

Investors should focus on selecting RERA-approved commercial properties from reputed developers with a strong track record in delivering projects on time and adhering to legal requirements. This ensures that the investment is secure and the project will be completed as promised.

Future Infrastructure Developments

The development of the RRTS, metro extensions, and highways will further boost the value of SCO plots in key locations. As these projects progress, the demand for commercial space in Gurgaon will increase, making it an excellent time to invest.

Wrapping Up: Are SCO Plots a Smart Investment for 2025-26?

Summary of Investment Benefits

SCO plots offer a high ROI, freehold ownership, and significant customization potential, making them a smart choice for investors looking for secure, long-term investments in Gurgaon. The dual-income potential from retail and office spaces, combined with low operational costs, makes them an appealing option.

Final Recommendation for Investors

Given the strong infrastructure growth, the increasing demand for commercial spaces, and the capital appreciation potential, SCO plots in Gurgaon are expected to remain one of the most profitable investment options for the next 5 years. Investors should seize the opportunity to invest before prices rise further.

Investors looking for high-return opportunities should explore the best commercial plots in Gurgao.n and consult a trusted property consultant to secure their SCO investments.

Final Thoughts

In conclusion, SCO plots present one of the best investment opportunities in Gurgaon for the coming years, with high rental yields, strong capital appreciation, and flexible design options. The ongoing infrastructure developments and growing demand for commercial properties make SCO plots in locations like Dwarka Expressway and New Gurgaon ideal for savvy investors looking for a high-return, low-risk option.

FAQs

- What are SCO plots in Gurgaon?

SCO (Shop-Cum-Office) plots are freehold commercial properties with retail spaces on the ground floor and office spaces on upper floors. - Why are SCO plots considered a good investment?

SCO plots offer dual-income potential, higher rental yields, freehold ownership, and long-term capital appreciation, making them a profitable investment option. - How does an SCO plot differ from traditional commercial property?

SCO plots offer greater flexibility in design, ownership (freehold vs leasehold), and usage (retail + office), which typically leads to higher yields and lower operational costs. - What is the expected rental yield from SCO plots in Gurgaon?

SCO plots typically provide rental yields of 6-8%, higher than traditional commercial properties, which offer 4-6% rental returns. - Are SCO plots in Gurgaon a secure investment for 2025-26?

Yes, with strong infrastructure growth, rising demand for commercial properties, and high capital appreciation potential, SCO plots in Gurgaon are considered a secure investment. - What is the capital appreciation potential of SCO plots in Gurgaon?

SCO plots in emerging corridors like Dwarka Expressway and New Gurgaon are expected to see steady capital appreciation due to ongoing infrastructure development and growing demand. - Can I customize my SCO plot design?

Yes, SCO plots offer high customization potential with the ability to build G+4 structures, allowing investors to design their properties to fit their business needs. - What are the tax benefits of investing in SCO plots?

Investors in SCO plots can benefit from depreciation deductions, rental income tax exemptions, and capital gains tax advantages based on ownership duration. - Is it possible to get ready-to-move SCO properties in Gurgaon?

Yes, there are several ready-to-move SCO properties in Gurgaon available for immediate rental income, such as Vatika Crossover and M3M 114 Market. -

How do I verify if an SCO plot is a good investment?

Look for properties that are RERA-approved, located in prime areas with strong infrastructure plans, and offered by reputed developers with a solid track record.